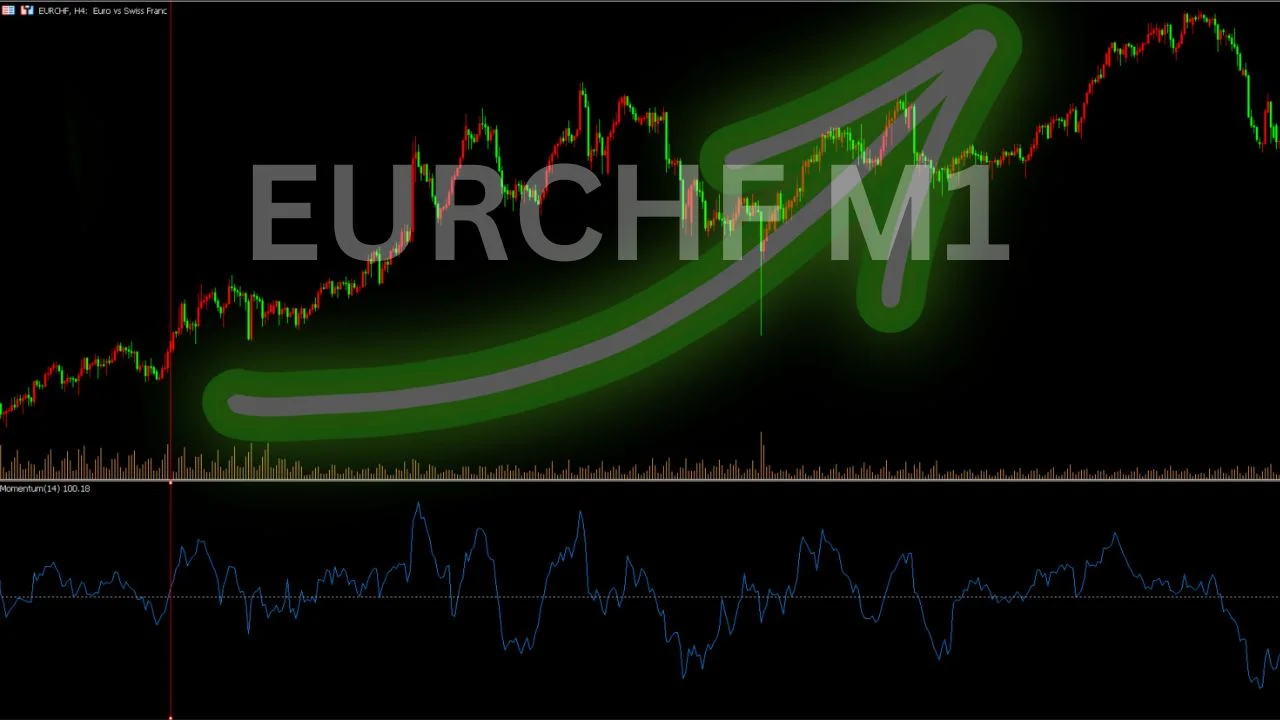

Imagine catching small price moves in just minutes – that’s the power of scalping! We’ll look at a simple 1 minute EURCHF scalping strategy using the Momentum Indicator. This tool helps you spot the best times to enter and exit trades quickly. If you’re new to scalping or want to improve your trading, This strategy will help you make quick choices and earn from small price changes in the EURCHF scalping. Let’s get started!

What is the Momentum Indicator, and Why Should You Care for EURCHF Scalping?

Picture watching the EURCHF market and not knowing when to trade. The price is moving, but you’re unsure. That’s when the Momentum Indicator helps. It shows how fast the price is changing and signals when a trend is likely to keep going, giving you confidence to act. When the market is down, it might be time to step back. If you use the Momentum Indicator, you’ll easily point out the best times to enter and exit trades For EURCHF scalping, making decisions clearer and boosting your confidence. It’s a guide to help you take action when the timing feels right.

How to Calculate the Momentum Indicator for EURCHF scalping

Setting up the Momentum Indicator for EURCHF scalping is easy to do. Here’s how it works:

- Formula 1: Momentum=Current Price−Price n periods agotext{Momentum} = text{Current Price} – text{Price} n text{periods ago}Momentum=Current Price−Price n periods ago

- Formula 2 (Alternative): Momentum=(Current Price n periods ago)×100text{Momentum} = left( frac{text{Current Price}}{text{Price} n text{periods ago}} right) times 100Momentum=(Price n periods ago Current Price)×100

If the Momentum value is above 100, it means the market is trending upwards. If it’s below 100, the market moves down.

How to Trade EURCHF Scalping with the Momentum Indicator

Set Up Your Chart

To start with EURCHF scalping,

- First, choose the EURCHF pair for your trade.

- Then, set your chart’s time frame to 1 minute. This is perfect for quick, short trades.

- After that, add the Momentum Indicator to your chart and set it to 14 periods. This will help you see the trends and know the best time to make your move. Now, you’re ready to watch the market and trade with confidence!

Look, it’s Buy Signals .

When the Momentum Indicator crosses above 100, it suggests bullish momentum. And That is a clear signal that the price is likely to rise. However, before jumping in, It’s always a good idea to double-check with other indicators or even look at price action to confirm the trend.

Finally, when it is confirmed, you can go ahead and buy the EURCHF pair. So, to protect yourself, make sure to set a stop-loss just below the recent low. Additionally, You’ll also want to aim for the next resistance level or set a fixed pip target to lock in profits.

Spot Sell Signals

When the Momentum Indicator crosses below 100, it indicates a bearish trend. And That is your cue to consider selling. However, Again, check other indicators or price action for confirmation before pulling the trigger.

For a sell trade, make sure you place a stop-loss above the recent high. a take-profit level should be set near the next support level, or you can use a pip target for You’ll your trade.

Pro Tips and Tricks

- Use Multiple Time Frames

If you Look at different time frames for EURCHF scalping, it will give you a better understanding of the market trend. This helps you avoid false signals and see the bigger picture.

- Combine with Other Indicators

Also, don’t depend only on the Momentum Indicator. Use other tools like moving averages, RSI, or MACD to double-check your trades. Using a mix of these tools can make your signals more reliable and help you make better decisions.

- Stay Updated on News

EURCHF, like all currency pairs, can be influenced by economic and political news. You must stay focused on major financial news releases for the Eurozone and Switzer Markets. these can impact your trades.

Risk Management: Keeping Your Capital Safe While Scalping EURCHF

If you’re scalping EURCHF, protecting your capital is everything. It’s not just about making the right moves; it’s something about being smart and not letting the market catch you off guard. It Is A safety Plan. By managing your risks, you make sure you can keep trading even if things don’t go the way you expect. Therefore, It’s all about playing it safe while still taking advantage of those opportunities

- Set Stop-Loss Orders: First, I would prefer you Always Set Stop-Loss Orders To reduce Your Losses. This helps you stay consistent in your life and prevents emotional decision-making, volatile time-sizing

- Keep your position sizes in check: Second, Keep your position sizes small to avoid unnecessary Risks and trade amounts that suit your balance and risk tolerance.

- Track Your Performance: Third, Remember to review Its trades regularly to understand what’s working and what needs improvement. Use the insights to adjust your strategy as you go.

Why EURCHF Scalping with the Momentum Indicator Works

Let me explain it to you. Firstly, EURCHF is highly liquid, making it great for scalping. Next, The Momentum Indicator helps you track price changes so you can catch trends at the right time. If you follow my explained disciplined approach, you’ll increase your chances of success while keeping risk under control.

Final words: Mastering EURCHF Scalping with Momentum Indicator.

Momentum Indicator is a very powerful tool for EURCHF scalping. It helps you identify a trend that is gaining strength so you can jump in at the right moment and lock in profits. By combining the Momentum Indicator with other technical tools and practicing solid risk management, you’ll be in a great position to maximize your earnings from EURCHF scalping

Keep things simple, stick to the plan, and with time, you’ll see the benefits of using this strategy in your trading techniques. Happy trading!

More Strategies Crafted by TradingBotLab

- Scalping Strategies

- Trend Following Strategies

- Breakout Strategies

- Carry Trade Strategies

- Counter Trend

- News Trading

- Range Trading