If you want to make big profits from trading, mastering the break and retest strategy can level up your game. In this article, I’ll break it down for you step by step, showing you exactly when to buy or sell using this simple strategy. Let’s jump into the article!

Break and Retest

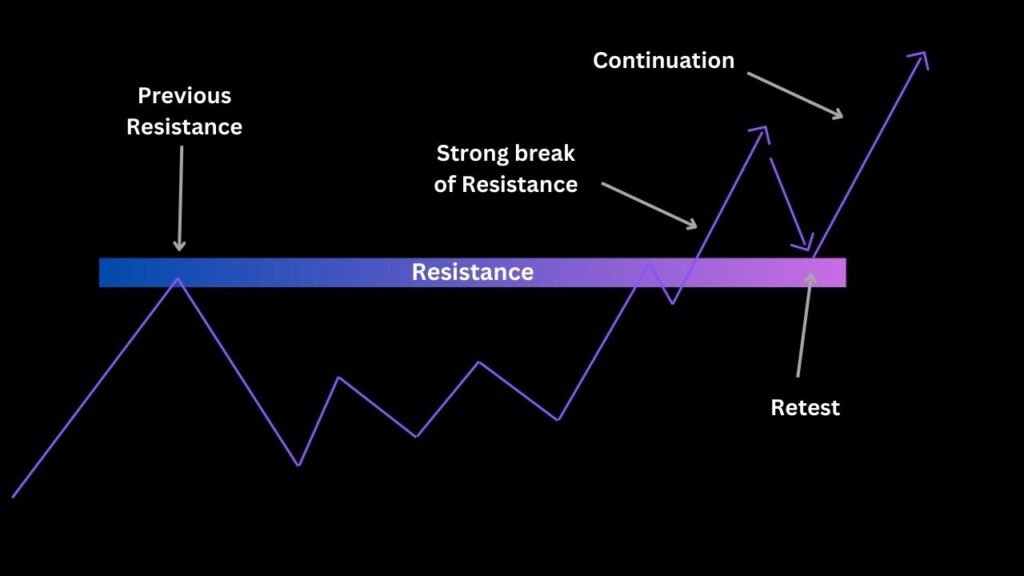

The break and retest strategy involves waiting for the price to break through the key level (either support or resistance) and then retest that level before entering a trade. This strategy is very popular because it helps traders confirm trends and avoid false breakouts.

In simple terms:

- Break: The price moves through a level of support or resistance.

- Retest: The price returns to that level to “test” it, giving you a chance to enter a trade.

Key Concept: Price Doesn’t Move in One Direction Forever

Keep in mind that the price of an asset won’t keep moving in the same direction forever. For example, when the price is going up in an uptrend, sooner or later, it’s going to reverse and start heading down. The break and retest strategy is based on this idea—once the price breaks a level, it will come back to test that level before continuing its movement.

How to Apply the Break and Retest Strategy

- Identify Key Levels Before the break happens, you need to find strong support or resistance levels. These are areas where the price has struggled to move past multiple times.

- Wait for the Break Watch for the price to break through these key levels. However, don’t jump into a trade right away. Many traders make the mistake of entering the market as soon as the price breaks a level, but this can lead to losses if the breakout is false.

- Watch for the Retest After the price breaks a level, it often comes back to test that level again. This is your opportunity to enter the trade. When the price returns to the broken level and shows signs of respecting it (for example, it starts moving away from it), that’s your signal to act.

- Confirmation with Patterns Sometimes, patterns like M or W shapes form during a retest. For example, if the price forms an M pattern after breaking a resistance level, this confirms a reversal from an uptrend to a downtrend. You can use these patterns as additional confirmation for your trades.

When to Buy

You should buy when:

- The price was in a downtrend, breaks a resistance level, and then returns to test that level.

- On the retest, the price shows signs of respecting the broken level, such as bouncing up or forming a pattern like a W.

- More buyers enter the market at this point, and the price starts pushing higher. This is your entry point.

Example:

Picture this: the price breaks through a key resistance level and moves up. After a while, it comes back to that same broken resistance, which now works as support.Once the price starts moving away from this support level, that’s your buy signal.

When to Sell

You should sell when:

- The price was in an uptrend, breaks a support level, and then comes back to test that level.

- On the retest, the price struggles to break back above the support level, signaling that the buyers are losing strength.

- More sellers come into the market, and the price starts to drop. This is the perfect moment for you to enter a sell trade.

Example:

Let’s say the price drops below a strong support level and starts falling. Sooner or later, it comes back up to test that same level, which now acts as resistance. When the price hits the resistance and starts heading down again, that’s your cue to sell.

Common Mistakes to Avoid in break and retest strategy

- Entering Too Early: Wait for the retest to be confirmed before entering a trade. If you enter as soon as the price breaks a level, you risk falling into a false breakout.

- Ignoring Confirmation Patterns: Use additional confirmation tools, such as chart patterns or candlestick formations, to strengthen your trade entry.

- Not Waiting for a Clear Retest: Sometimes the price doesn’t fully retest the broken level or moves too quickly. Be patient and wait for a clear retest before taking a position.

Break and Retest in Trending and Sideways Markets

- In a trending market, the break and retest strategy works best because the price is continuously moving in one direction. In an uptrend, look for opportunities to buy after a retest of a broken resistance. In a downtrend, look for selling opportunities after a retest of a broken support.

- In a sideways market, the price moves between levels without a clear trend. Here, you can wait for the price to break out of the range, retest the broken level, and then enter your trade.

Live Trading Application

In real-time trading, you might see the price break through a support level in a downtrend, retest the level, and then push further down. Let’s say we see a break below support followed by a retest. Once the price retests the broken support, forming a strong resistance, we look for signs of selling pressure. When these signs appear, it’s time to sell.

Conclusion

The break and retest strategy is powerful because it helps confirm whether a breakout is real or fake. By waiting for the price to break a key level, return to that level, and then move in the direction of the trend, you increase your chances of success. Remember to be patient, wait for clear retests, and always use confirmation before entering a trade.

Stay tuned for more advanced trading strategies and tips.

Happy trading!